Published on Wed, 2015-07-08 11:07

With pens still hovering over the Addis Ababa Action Plan, the outcome agreement for the Third International Conference on Financing for Development (FfD3), there is already a sense that for all the recent talk at the UN about ambition and transformation, it is falling short. For a financing document, the Action Plan includes an impressive number of references to issues at the core of sustainable and inclusive development, like social protection, essential services, decent work for all and sustainable industrialization. There are multiple references to consumption and production, a rebalancing of which, among the rich and the poor, will determine the future of our world. |

Published on Tue, 2015-07-07 15:00

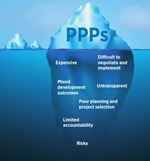

A new report launched by Eurodad examining public private partnerships (PPPs) as a way to finance development projects finds that they are risky and expensive and urges governments and financial institutions to stop hiding their true costs. The research finds that public private partnerships are expensive, risky and lack transparency. What lies beneath?: A critical assessment of public private partnerships and their impact on sustainable development examines the nature and impact of PPPs ahead of the landmark Financing for Development (FfD) conference in Addis Ababa next week (13-16 July). It analyses existing literature on PPPs and the experiences of Tanzania and Peru, based on the findings of the networks Afrodad and Latindadd. |

Published on Tue, 2015-07-07 13:34

A graphic summary of the state of the negotiations around the post-2015 development agenda in the first days of July, showing where there is consensus and who is behind the different conflicting propositions. Green, Yellow, Red The issues highlighted are arranged in 4 groupings: - Preamble and declaration - Goals and targets - Means of implementation. - Follow-up ad review These groupings mirror the four main sections of the draft UN outcome document for the post-2015 development agenda currently being negotiated by governments at UN headquarters in New York. This summary was compiled by GPW based on national and negotiating group interventions in 3 main clusters. |

Published on Mon, 2015-07-06 00:00

The open-ended intergovernmental working group in charge of elaborating an international legally binding instrument on transnational corporations (TNCs) and other business enterprises with respect to human rights convened its first session in Geneva on Monday. The inaugural session of the Working Group (6-10 July) appointed Ambassador Maria Fernanda Espinosa of Ecuador as its Chairperson-Rapporteur. The session opened with a video message from the United Nations High Commissioner for Human Rights Mr Zeid Ra'ad Al Hussein. It also heard some opening remarks by its keynote speaker, Ms Victoria Tauli-Corpuz, the United Nations Special Rapporteur on the rights of indigenous peoples, who told the delegates that an international legally binding instrument on business and human rights could contribute to redressing gaps and imbalances in the international legal order that undermine human rights, and could help victims of corporate human rights abuse access remedy. |

Published on Sun, 2015-07-05 00:00

The implementation of the Financial Services Law, passed in Bolivia in August 2013, has marked the political rhythm of the financial system in the country. The government set the pace for the private banks within its public policy of access to financial services, privileging specific actors, in particular the wage-earners and small and medium enterprises. The law marked the economic rhythm for the sector, too. The body of macroeconomic policies prioritizing price stability and an exchange rate that strengthened the position of the Bolivian peso compared to the US dollar and other currencies and an external environment of high prices for the commodities the country exports, generated a scenario of liquidity and growth for the financial sector in particular and the economy as a whole. |