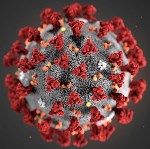

Corona-virus to hit the Global South even harder

Published on Sat, 2020-03-21 10:14

The Covid-19 pandemia is a global health crisis (with major financial and economic consequences) but international organizations, starting with the World Health Organization “are still insufficiently funded to respond quickly to the emergence of dangerous diseases - and to prevent them from spreading to global pandemics” argue Jens Martens and Bodo Ellmers, from Global Policy Forum in a briefing paper published last March 18. People in most Global South countries are likely to suffer its impact even more and therefore “in order to prevent the corona crisis from becoming a global development crisis, solidarity must not end at national borders.” The Covid-19 pandemia is a global health crisis (with major financial and economic consequences) but international organizations, starting with the World Health Organization “are still insufficiently funded to respond quickly to the emergence of dangerous diseases - and to prevent them from spreading to global pandemics” argue Jens Martens and Bodo Ellmers, from Global Policy Forum in a briefing paper published last March 18. (The briefing is available, in German, at https://www.globalpolicy.org/images/pdfs/Briefing_Corona_Weltwirtschaft.pdf) The problem is not new, it had already been shown in the Ebola crisis in West Africa in 2014/15. The World Bank then launched an innovative financing instrument that should make it possible to react quickly to future pandemics, but the instrument was so badly designed that so far it has benefited investors rather than the countries concerned. The whole extent of the corona crisis is still far from foreseeable. It is feared that people in many countries in the Global South will feel the foothills of the crisis even more than people in the richer industrialized countries. There are three main reasons for this: 1. Many countries in the Global South are already experiencing a social, economic and political crisis that is exacerbated by the effects of the corona pandemic. Due to their structural weaknesses, they are more vulnerable to exogenous shocks and suffer longer from the consequences of crisis. 2. The richer countries can afford to cushion the crisis socially and economically. They have comprehensive social security systems and have set up financial rescue packages for their economy. Most countries in the Global South lack the financial scope for such measures. 3. The financial aid measures of the industrialized and emerging countries give the local companies a competitive advantage over their already weak competitors in the developing countries. In doing so, they are exacerbating the disparities between industrialized and developing countries, but also between poorer developing countries and emerging countries such as China. In order to prevent the corona crisis from becoming a global development crisis, solidarity must not end at national borders. Rather, the political reactions of the governments to the corona crisis must systematically take into account the global socio-economic and ecological consequences. In practice, internationally coordinated responses to the crisis are very slow and far from sufficient so far. In order to curb the further spread of the new Corona virus worldwide and to support countries with weaker health systems, the WHO had already asked for funds of USD 676 million for the months of February to April 2020 in a "Strategic Preparedness and Response Plan" at the beginning of February . At the beginning of March, the United Nations made only $ 15 million available for global measures to combat COVID-19 as part of its Central Emergency Response Fund (CERF). As this was far from sufficient, the WHO, together with the UN Foundation, created the COVID-19 Solidarity Response Fund (www.COVID19ResponseFund.org), which is supposed to receive donations from companies and individuals and to pass it on to WHO for corona control purposes. In a background paper on the corona crisis, the United Nations Conference on Trade and Development (UNCTAD) emphasizes that countries with functioning public health systems can best respond to challenges such as corona and calls on governments to provide the necessary means to strengthen universal public health care. This can be counter-financed, among other things, by effectively combating tax evasion and ruinous tax competition as well as by debt restructuring in the highly indebted countries. In addition to the direct financing of health tasks as part of the fight against corona, massive interventions will also be required to counter the negative economic consequences of the corona crisis and to prevent or at least alleviate a global economic recession. Many national governments have announced grants that are primarily intended to benefit the domestic economy. Governments in poorer countries naturally have less financial leeway to support their economies. They need cross-border support. Some multilateral initiatives have already been announced: On March 13, the European Commission announced an "Investment Initiative to Address the Corona Crisis". The problem with the EU is, however, that its budget is long-term and extremely limited. Commission President von der Leyen can only work with reallocations. 8 billion euros are to be released, above all through the use of undrawn funds from the structural funds. Co-financing from the member states is intended to enable investments totalling 37 billion euros. The World Bank announced at almost the same time a first package of measures of $ 12 billion in COVID-19. The funds are primarily intended to strengthen health systems and support the private sector in coping with the economic consequences of the crisis. The International Monetary Fund (IMF) has announced that it will provide up to $ 50 billion in emergency funding to low- and middle-income countries. The Fund generally has two lines of credit that can be used in emergencies such as the current corona crisis, the Rapid Credit Facility (RCF) and the Rapid Financing Instrument (RFI). It can be used to pay up to $ 10 billion in low-interest loans to low-income countries. There are also other instruments, such as the Catastrophe Containment and Relief Trust, which can finance debt relief for countries affected by disasters. However, the use of IMF funds may be counterproductive. During the Ebola crisis, the IMF was criticized for its harsh credit terms that had broken the health systems of affected countries and thus promoted the spread of the disease it was supposed to combat. In addition, numerous countries have already reached the limit of their debt sustainability and would therefore need grants rather than further loans. Countries that are in arrears with the IMF or the World Bank or whose debt is classified as unsustainable are excluded from support anyway, according to the IMF. This means that some of the most need countries will not have access to the IMF's pots - and those who have them will have to go into more debt to tackle a problem that they have not caused. The reactions of the leading central banks to the corona crisis are in far higher financial dimensions. Since the European Central Bank (ECB) cannot further cut the key interest rate as a monetary policy instrument because the interest rate was zero before the crisis, the ECB focused on expanding its bond purchase program and supporting banks with new long-term credit lines. Among other things, the Governing Council announced on March 12 that it would increase the asset purchase program (APP) by EUR 120 billion. The US Federal Reserve even announced after its special session on March 15 that it would support the American economy with a $ 700 billion bond purchase program and grants banks temporary emergency loans. » |

SUSCRIBE TO OUR NEWSLETTER